Daily Dogecoin (DOGE) Analysis

Making decisions about buying or not buying Dogecoin requires careful evaluation of multiple factors. This cryptocurrency is known for its extreme price volatility, often influenced by market sentiment and social media news. Additionally, its active online community and occasional endorsements from celebrities can drive increased demand and price surges.

June 1 Analysis

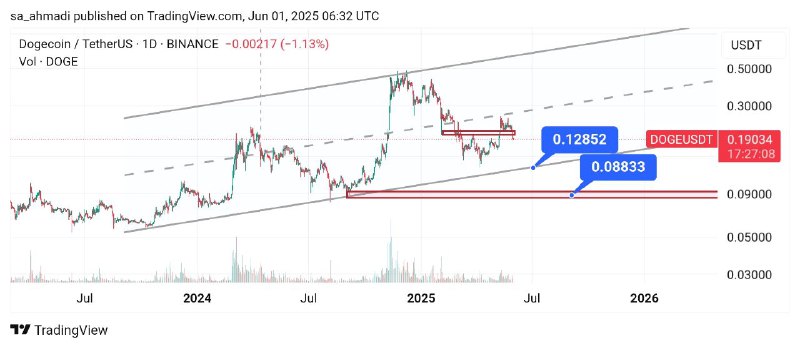

As shown in the chart, Dogecoin has been moving within an ascending channel since 2024, testing the channel’s lower boundary multiple times. In its most recent downward leg, DOGE initiated an upward move before reaching the channel’s base, potentially forming a double-top pattern.

The neckline of this pattern was at $0.01, which was broken downward with strong bearish candles.

If Bitcoin continues its downtrend, DOGE’s first correction target is the $0.12–$0.13 support zone (channel base).

A breakdown below this level could lead to a drop toward $0.08 (last major support).

Conversely, if Bitcoin holds above $100K and targets new highs, DOGE could rebound toward the $0.16 resistance and potentially the upper channel boundary.

(This analysis reflects Homoro’s technical perspective and is not a buy/sell signal.)

April 16 Analysis

DOGE is in a corrective phase (4H timeframe), confined to a descending channel.

Key support: $0.12–$0.13 (potential bounce zone).

A breakout above the channel could target $0.198 → $0.21.

As the leading meme coin, DOGE benefits disproportionately from capital inflows into this category during altcoin rallies.

March 3 Analysis

DOGE moves within a downtrend channel (4H chart), with clear bearish momentum.

Despite temporary bullish reactions (e.g., Trump-related news), it faced rejection at $0.23–$0.24.

Short-term correction likely toward $0.18–$0.19 before any upward reversal.

A channel breakout could propel DOGE to $0.27 → $0.29.

Long-Term Outlook:

As a high-profile meme coin, DOGE remains prone to sharp rallies driven by hype (e.g., Elon Musk’s endorsements) and is a speculative but high-potential asset during altcoin seasons.

Dogecoin (DOGE) Overview

Analyzing Dogecoin enables investors to make smarter investment decisions by carefully evaluating profit potential and identifying possible risks. This purposeful process provides a clear perspective on the current status and future outlook of this digital asset. The Homoro team, relying on specialized knowledge and extensive experience in financial markets, offers comprehensive and practical analyses of Dogecoin so that market participants can operate with greater confidence in this field.

About Dogecoin

Dogecoin (DOGE) was developed in December 2013 by Jackson Palmer and Billy Markus as a cryptocurrency based on an “internet meme.” Despite its informal origins, the project has become one of the most popular cryptocurrencies due to its active user community and low transaction fees. Dogecoin is inspired by the image of a Shiba Inu dog from the “Doge” meme and was initially created as a humorous response to the uncontrolled growth of cryptocurrencies. One notable feature of Dogecoin is its unlimited supply model.

Should We Buy Dogecoin or Not?

Deciding whether to buy Dogecoin requires careful evaluation of multiple factors. Extreme price volatility, often influenced by market sentiment and social media news, is a hallmark of this cryptocurrency. Additionally, its active online community and occasional endorsements from celebrities can lead to increased demand and price surges.

Most Important Advantage of Dogecoin

One of Dogecoin’s most significant advantages is its large and active online community. This community often plays a prominent role in various events through its support, greatly contributing to raising awareness and adoption of this cryptocurrency. Furthermore, the low transaction fees on the Dogecoin network make it an attractive option for investors.

Factors Influencing Dogecoin’s Future

Dogecoin’s future is shaped by various factors that are crucial for investors to consider. One such factor is endorsements from globally renowned economic and political figures. Statements and actions by influential individuals, especially on social media, have consistently caused significant fluctuations in Dogecoin’s price.

Another factor is the level of commercial adoption of this cryptocurrency. As more businesses accept Dogecoin as a payment method, its demand and, consequently, its value can grow. Technological developments also play an important role; any improvements in Dogecoin’s infrastructure and technology can enhance its appeal and efficiency.

What Makes Dogecoin Different from Other Cryptocurrencies?

Dogecoin possesses distinctive features compared to many other cryptocurrencies in the market. One key difference is its non-serious origin. While most cryptocurrencies were created for specific functional purposes, Dogecoin initially emerged purely as an internet meme/joke.

Another difference is Dogecoin’s unlimited supply. Unlike cryptocurrencies like Bitcoin that have a fixed supply cap, there is no limit to the number of Dogecoin units that can be mined. However, Dogecoin benefits from a highly active online community that plays a significant role in its preservation and expansion. Additionally, transaction fees on the Dogecoin network are typically lower than many other cryptocurrencies, and its transaction speed is relatively fast.

Rules for Buying and Selling Dogecoin

Trading Dogecoin, like other cryptocurrencies, requires adherence to fundamental rules and considerations. First and foremost, always use reputable cryptocurrency exchanges with established track records for buying and selling Dogecoin. After purchasing, store your assets in secure wallets to maintain their safety.

Risk management is also critically important: never invest your entire capital in Dogecoin trades, and always set stop-loss orders for your transactions. Before any buying or selling activity, conducting thorough research and analysis of Dogecoin is essential.

Dogecoin Analysis Methods

Various methods can be employed to analyze Dogecoin, each offering different perspectives.

Technical Analysis

Technical analysis primarily focuses on examining price charts, trading volume, and technical indicators. In other words, the goal of this type of analysis is to identify price patterns and predict future trends. Tools such as moving averages, Relative Strength Index (RSI), and MACD indicator are among those used in Dogecoin’s technical analysis. Through the technical training courses offered by Homoro, you can fully master how to work with these tools.Fundamental Analysis

Fundamental analysis examines the qualitative and foundational factors related to Dogecoin. These factors include its adoption rate among businesses, network developments and updates, celebrity endorsements, and relevant news and events.On-Chain Analysis

On-chain analysis involves reviewing data recorded on the Dogecoin blockchain. This data includes the number of transactions processed, active network addresses, transfer volumes, and other network activity metrics.

Key Considerations in Dogecoin Analysis

When analyzing Dogecoin, paying attention to specific factors is particularly important. One crucial consideration is the significant impact of social media on its price. News and trends circulating on social networks can cause extreme volatility in Dogecoin’s price.

Additionally, the role of celebrities and their endorsements or comments can lead to sudden price fluctuations. On the other hand, the power and dynamism of Dogecoin’s user community should not be overlooked, as this community is a key factor in sustaining and expanding this cryptocurrency.

Finally, it’s important to note that due to its high volatility and meme coin nature, investing in Dogecoin carries substantial risk. For comprehensive and precise analysis, it’s recommended to combine multiple analysis methods while considering these key factors. Homoro’s specialized analyses are prepared and presented with all these aspects in mind.

onclusion

Analyzing Dogecoin requires a comprehensive understanding of its technical, fundamental, and on-chain aspects due to its unique nature. The Homoro team provides specialized educational courses supervised by Shahid Beheshti University and publishes up-to-date analyses through its channels to guide you in this process. To benefit from these services and receive the latest trading signals, you can visit our Telegram channel: @homoro_sale.

Frequently Asked Questions

If you have any questions or need clarification, you can contact our team of experts:

Is Dogecoin a suitable investment option?

The decision to invest in Dogecoin depends on various factors, including your risk tolerance, investment goals, and analysis results. It is recommended to conduct thorough research before taking any action.How can I acquire the necessary knowledge to analyze Dogecoin?

Enrolling in Homoro’s comprehensive training courses, which offer official certification from Shahid Beheshti University, can help you gain the knowledge and skills needed to analyze Dogecoin and other cryptocurrencies.What factors influence Dogecoin’s price?

The most significant factors affecting Dogecoin’s price include celebrity endorsements, social media trends, overall cryptocurrency market developments, and its adoption by users and businesses.

For further inquiries or real-time updates, join our Telegram channel: @homoro_sale.