A stock market signal channel is a channel that provides users with appropriate suggestions for buying and selling stocks at specific times. Receiving stock signals – provided they come from reliable and credible sources – is a simple way to make better decisions in Iran’s stock market transactions. If you’re new to this market or worried about making mistakes in market analysis, a reputable stock signal channel can help you make better decisions for your trades. In the following sections, we’ll explain everything about stock signal channels to help you make a better choice.

Stock Market Signal – June 3

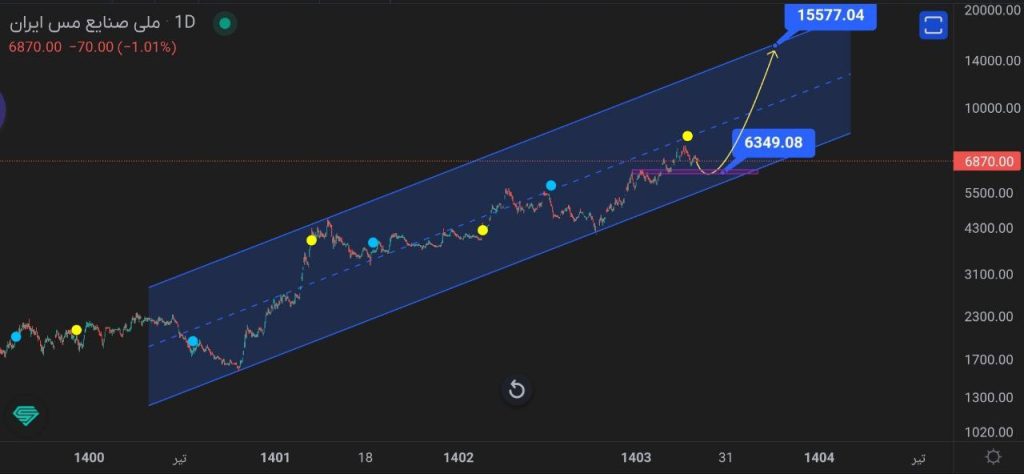

National Iranian Copper Industries Company (NICICO) stock, as one of the most profitable companies in the stock market, is highly promising and powerful for mid-term and long-term investment.

Mid-term and long-term investment in this stock is always recommended. Although its upward trend may be slightly slower compared to other stocks, it consistently compensates for its lag and achieves significant growth in the mid- or long-term. For example, after the market downturn in 2020, it underwent approximately two years of correction and sideways movement before entering an upward channel, and to date, it has experienced over 400% price growth.

As visible in the chart, this stock has been moving between the upper and lower bounds of this channel and is currently interacting with the midline of the channel.

After breaking the crucial 600-toman resistance level, the stock is currently retesting this zone. It appears that upon reaching the 600-toman range, it will resume its movement toward the upper channel boundary. Therefore, the primary target zone for this stock can be considered 1500 tomans, and if this upward channel is broken to the upside, much higher targets can be anticipated.

Iran Stock Market Signal – June 1

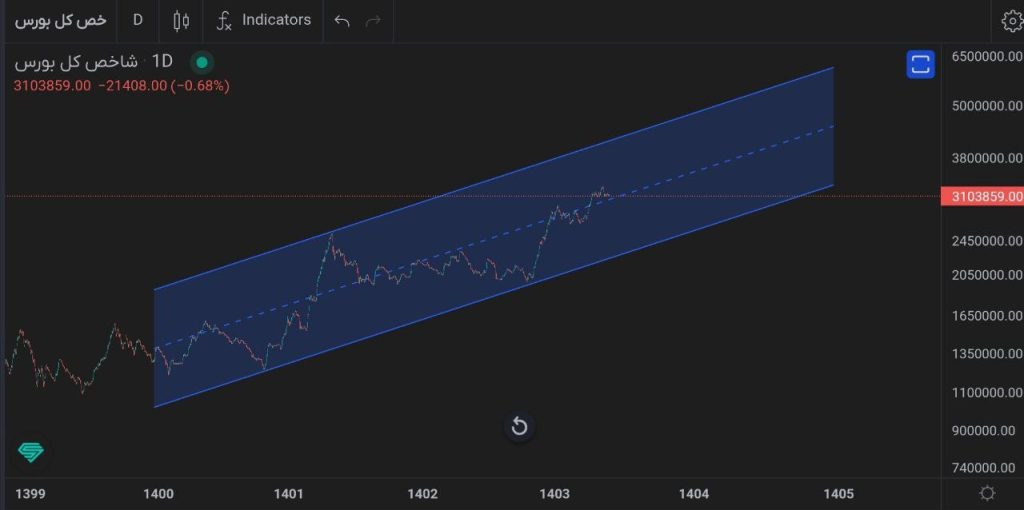

The overall stock index began an upward movement from mid-2022 and has since been moving within an ascending channel visible in the chart.

After hitting the channel’s lower boundary several times in its final phase since late 2025, the index started a strong upward leg and powerfully broke through the 3 million unit level. Currently, the index is pulling back to test the 3 million unit level.

If Iran-US negotiations continue positively and the stock market remains optimistic about the country’s stability and capital injection, the index could maintain the 3 million unit level and move toward 4 million units as its first target.

Note that in the recent upward trend, not all stocks have grown equally. Stocks in the automotive and banking sectors have experienced significantly more growth compared to other index-driving groups. Therefore, if you wish to invest in the Iranian stock market, you could invest in high-potential stocks from these two groups and hold them until the 4 million unit level.

What is a Stock Market Signal?

In simple terms, a stock market signal is a suggestion to buy or sell a stock at a specific time and price. This suggestion includes entry point, exit point, and stop-loss to reduce risk. Essentially, the purpose of stock signals is to simplify trading for those who lack time or expertise for analysis.

From beginners to professionals, everyone can use signals. A good signal increases profits, but it must come from a reliable source.

Types of Stock Signals

Signals differ based on analysis type and trading purpose. Below are the main types:

1-Technical Signals

Created using price charts and tools like indicators. For example, a signal may be given when a resistance level is broken.

2-Fundamental Signals

Based on company financial performance, such as profits or CODAL reports. Suitable for long-term investments.

3-Short-term vs. Long-term

Short-term signals work well for swing trading over days/weeks. Long-term signals are designed for months/years. Each type has its own application with no inherent superiority.

Who are the Best Stock Signal Providers?

Choosing the right signal channel is crucial. Many Telegram channels exist, but not all are trustworthy. A good channel should transparently show performance – e.g., disclose what percentage of past signals were profitable.

Reputable channels provide precise signals with both technical and fundamental analysis. They show historical performance and offer customer support. Transparent information builds trust and increases success chances.

The Homoro Group, as a leading financial market authority, delivers reliable daily signals via Instagram and Telegram. These signals are prepared by market experts with complete transparency for channel members.

Characteristics of the Best Stock Signal Channels

When selecting a channel, consider:

High success rate (quality channels typically exceed 70% profitability)

Analysis with signals (signals without explanations are insufficient – reputable providers justify each recommendation)

Fast execution & support (critical in the dynamic stock market environment)

Guide to Using Free Stock Signal Tables

Many channels offer free signal tables containing key information. To use them effectively:

Entry point: Buy price

Exit point: Sell price to realize profits

Stop-loss: Sell price to limit losses if the market declines

Execute signals through platforms like MofidTrader or brokerage systems. Always test signals in a demo account before live trading to verify their validity.

Are there quality free stock signals available?

Many people look for free signals to trade without cost, but are these signals worthwhile? In response to this question, it must be said that these signals typically have low accuracy, around 50 to 60 percent or perhaps even less. This means you may lose money half the time. The reason is that precise analysis requires time and expertise, which free channels often lack.

Our stock signal channel provides signals with 70 to 85 percent accuracy or even higher. These signals come with strong analysis and increase profit potential. In conclusion, if you’re new, free signals are good for practice; but for consistent profits, premium channels perform better.

Telegram channel for stock signals and analysis

For stock channels, Telegram is considered the most common platform for information exchange due to its high speed and easy accessibility. A good channel doesn’t just provide signals; it also includes daily market analysis and important news like CODAL reports. This information helps you better understand the market and make correct decisions.

Professional Telegram channels provide daily precise analysis and signals. They also cover key company news so their users always stay ahead of others. If you want a channel that has everything in one place, our stock signal channel is a good choice.

How much does a VIP signal channel cost?

VIP channel membership usually has monthly or annual fees. These costs depend on signal quality, support, and additional services like exclusive analysis.

Joining our VIP channel has no specific cost. You just need to register on reputable Iranian exchanges using our referral link and provide your account information for verification. After verification, you’ll gain access to our stock signal channel and all our other channels.

Can anyone provide stock signals?

Providing stock signals is not easy. It requires deep knowledge of technical and fundamental analysis and real experience in the stock market. Someone who provides signals must be able to predict the market well and, more importantly, manage risk. However, some people provide signals without expertise, which may cause losses for users.

In reality, trusting unprofessional people is like gambling. That’s why our VIP channel only uses experienced analysts who have worked in the Iranian market for years. Each of our signals is prepared with great care. Things you should consider before choosing a stock signal channel:

Trade and signal evaluation process

To ensure the quality of stock signals, you must examine their performance. For this purpose, you can use CODAL to view companies’ financial reports or platforms like Mofid Trader for analysis.

Another good method is testing signals in a demo account. These accounts show you how signals perform without risking real money. If several consecutive signals are successful, you can trust the channel more.

Profitability of stock signals

Stock signals can yield good profits in bullish markets. An accurate signal enters you into trades at the right time and may bring you significant gains. But that’s not the whole story – profits also depend on factors like market conditions and your risk management.

In volatile markets, even strong signals may sometimes result in losses. That’s why you should always observe stop-loss limits and manage your capital wisely.

Are stock signals profitable?

Stock signals can be profitable, but they’re not guaranteed. Profitability depends on the signal’s accuracy, market volatility, and your trading approach. In rising markets, a good signal may yield 10-20% returns over a few weeks. But markets aren’t always favorable – during bearish or highly volatile periods, even strong signals may result in losses.

Important notes when using stock signals

Working with stock signals requires caution; pay attention to these points:

Take stop-loss seriously

If the stock reaches the stop-loss price, sell immediately. This prevents large losses.Manage your capital

Don’t put all your money on one signal. It’s better to use only 10-20% of your capital per trade.Don’t trust blindly

Even good signals can be wrong. That’s why you should check the market yourself or use analyses from our channel.

Which timeframe should be used to check trading signals?

The signal’s timeframe is very important for trading success. For short-term trading, daily or hourly timeframes work well. For long-term investments, weekly or monthly timeframes are more suitable. What matters most is that the signal matches your trading style. For example, if you prefer quick trades, focus on shorter timeframes.

Final words

A stock signal channel can make your trades in the Iranian stock market easier and more profitable. With our VIP channel, you get accurate signals, strong analyses, and quick support. But success doesn’t depend only on signals. You must observe stop-loss, manage your capital well, and test signals in a demo account. The stock market is full of opportunities but requires careful attention. To get started, join our channel and proceed with confidence. If you want to learn more, read our article “How to invest in the Iranian stock market?”

The stock market is full of golden opportunities, but finding the right path requires guidance. With years of experience, the Homoro group provides precise signals and transparent analyses in its stock signal channel (@homoro_sale) on Telegram. We recommend joining our channel now and starting profitable trades with confidence.